In accordance with the Spanish Law the donation is gift by which a person (donor) disposes one thing in favour of another (donator), who accepts it.

The Donation tax in Spain is payable by the beneficiaries, this means by the donator (who is the person favoured in the transaction).

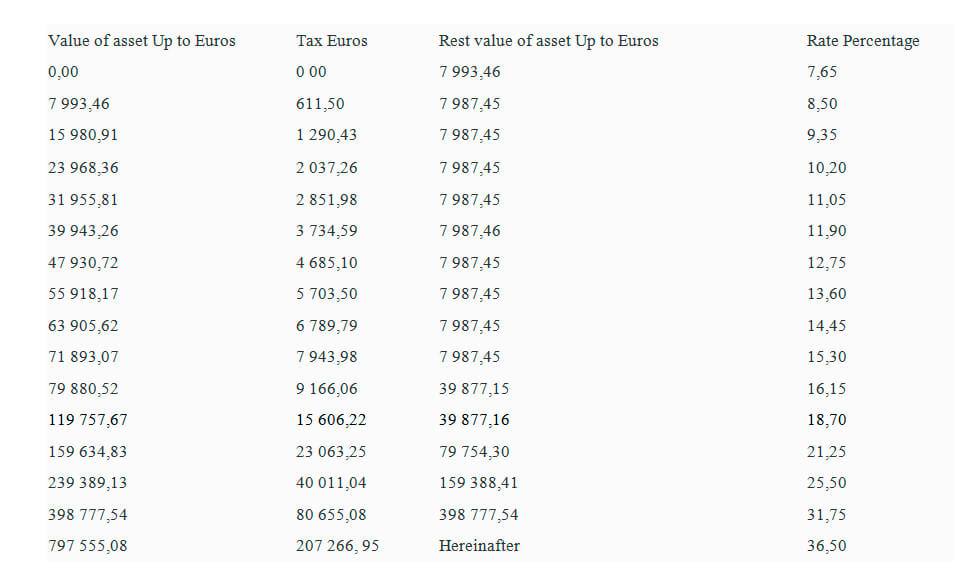

- The applicable rate to calculate the donation tax in Spain depends on the value of the donation. The rates for the donation tax in Andalucía, Spain are the following:

Once the total quota has been calculated, a multiplier coefficient must be applied, which depends of the following:

- a) Blood relationship

There are four groups of blood relationship:

-

- Group I: Descendants, adopted children under 21 years old.

- Group II: Descendants and adopted children over 21, spouses, parents, adopted parents.

- Group III: 2nd and 3rd grade family: brothers-sisters, nephews-nieces, aunts-uncles.

- Group IV: Those not mentioned in groups 1, 2, 3 above, friends, etc.

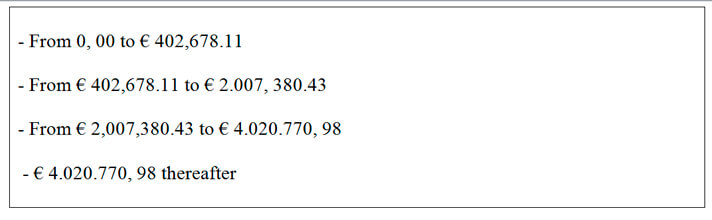

- b) Pre-existing wealth of the donatorIn accordance with the pre-existing wealth of the donator, the donator will be included in one of the following groups:

Having established the above, the corresponding applicable coefficient will be as follows:

Do not hesitate to contact our English speaking law firm in Marbella if you wish to obtain further information regarding the donation Tax in Andalucia, Spain

Our firm will assist you at the time of granting the Spanish donation deed, settle the Spanish Donation taxes and registration of the property donated at the Land Registry.

Related content:

Tax aspects in the purchase – sale of real estate in Spain.

Social Media